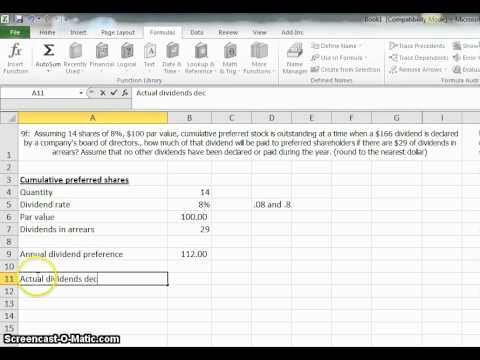

cumulative preferred stock dividends in arrears

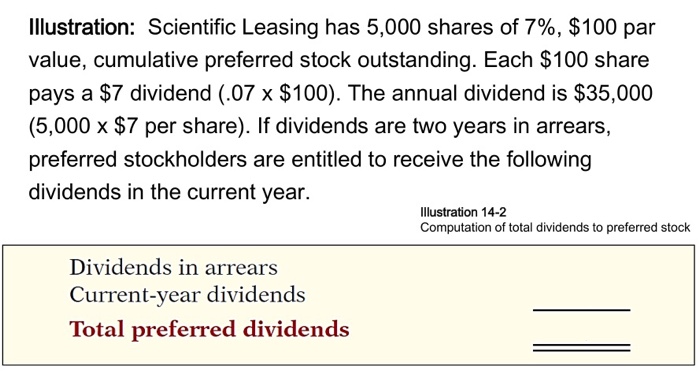

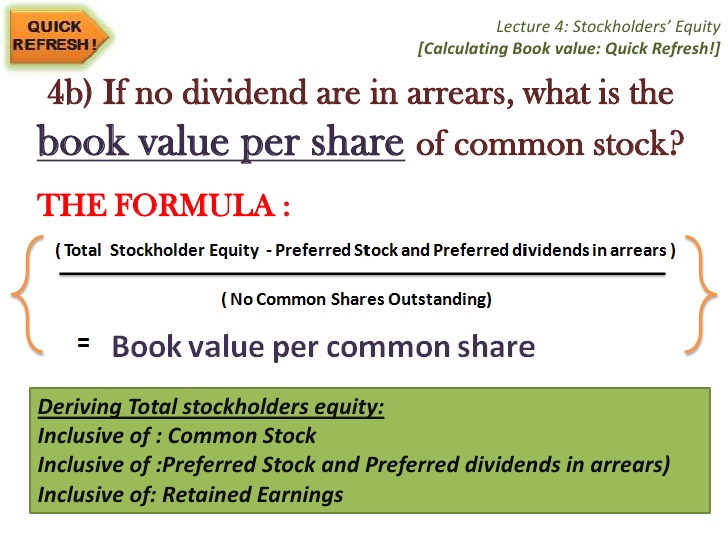

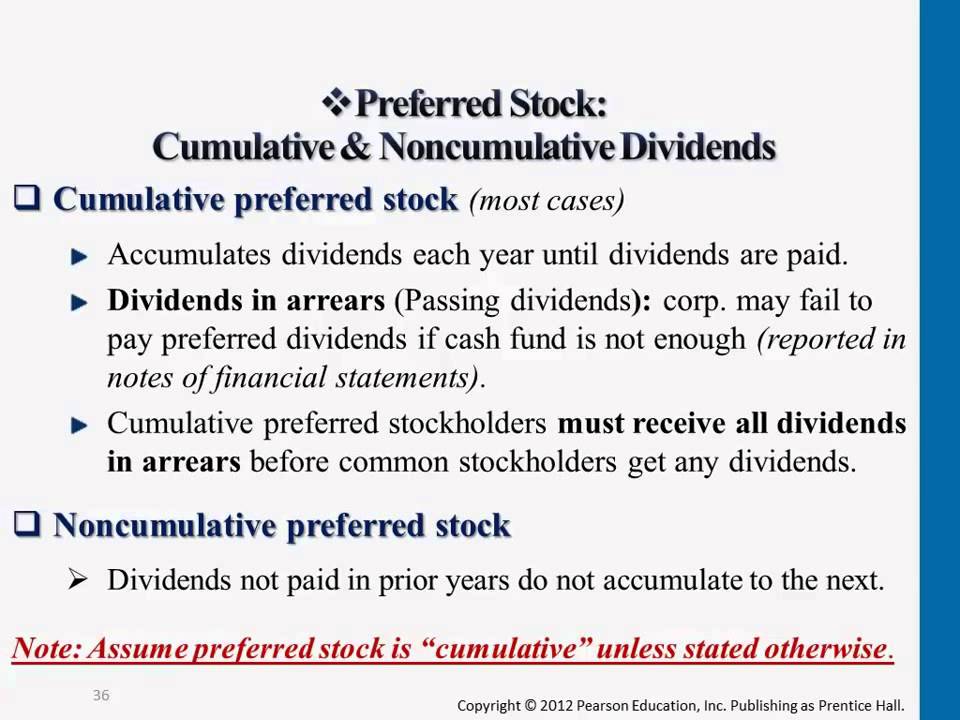

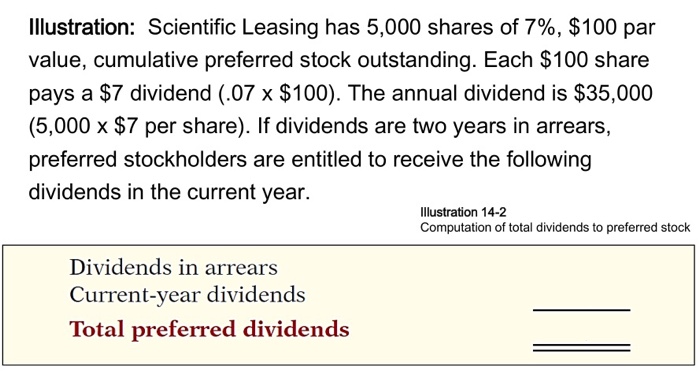

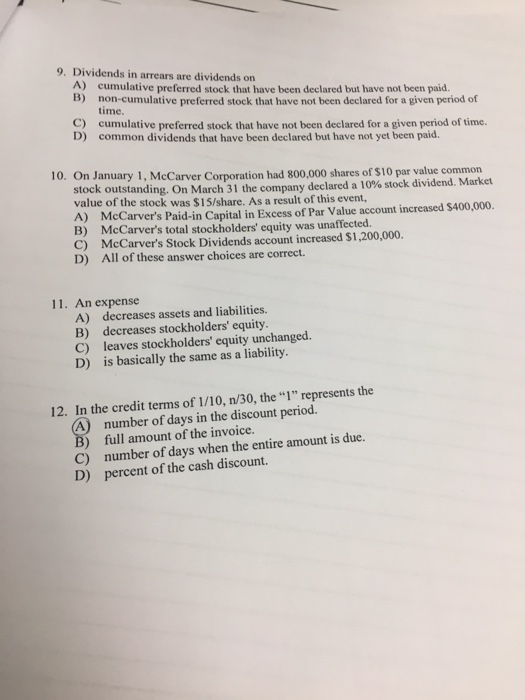

Disclosure of dividends in arrears on cumulative preferred stock. When a company has dividends in arrears on its cumulative preferred stock only the current years preferred dividend is deducted in the earnings per share computation.

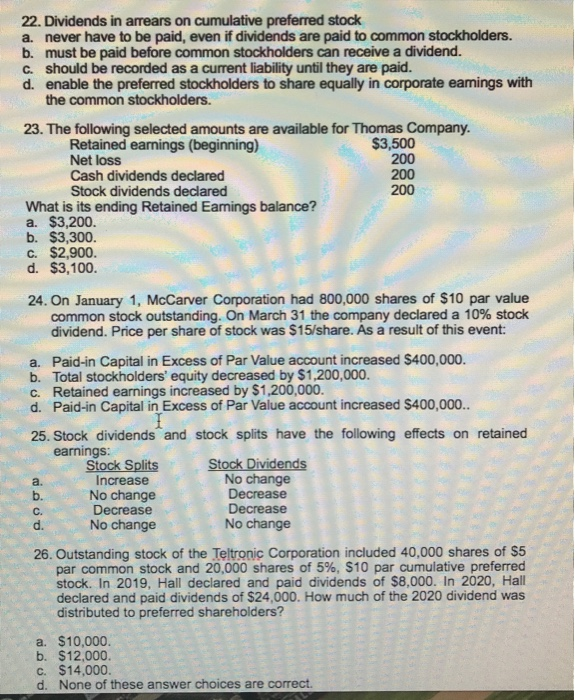

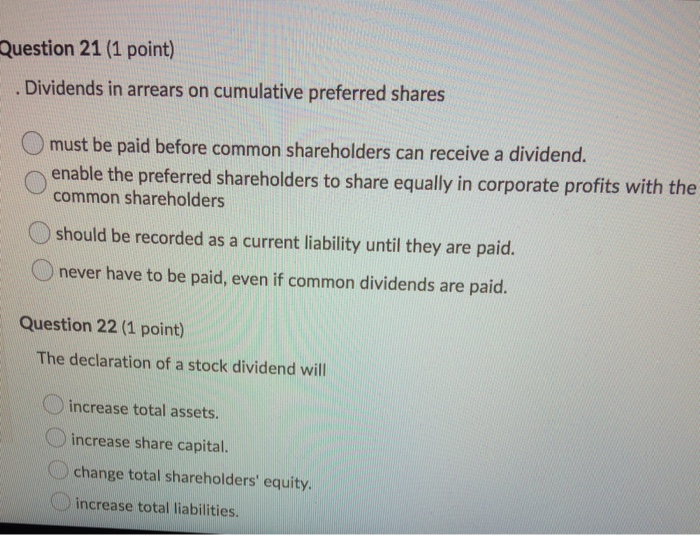

Solved 22 Dividends In Arrears On Cumulative Preferred Chegg Com

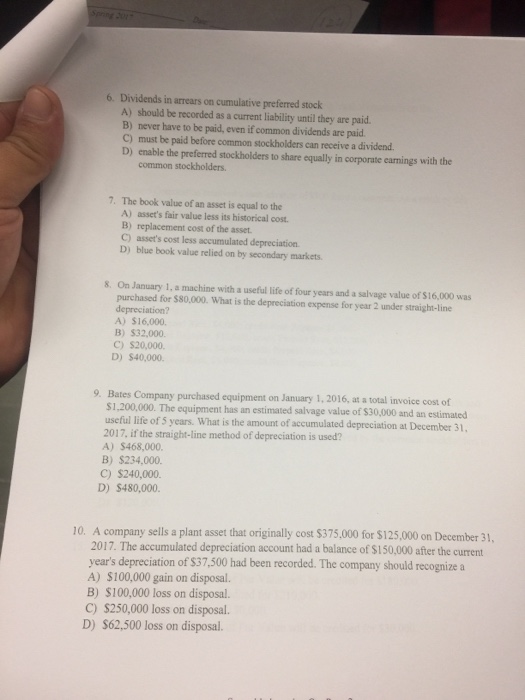

Dividends in arrears on cumulative preferred stock A should be recorded as a current liability until they are paid.

. When a company has dividends in arrears on its cumulative preferred stock only the current years. In this case cumulative refers to the fact that these dividends will accumulate until payment. In year six preferred stockholders are not owed any dividends in arrears.

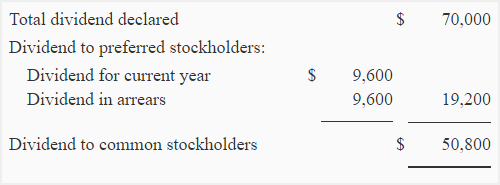

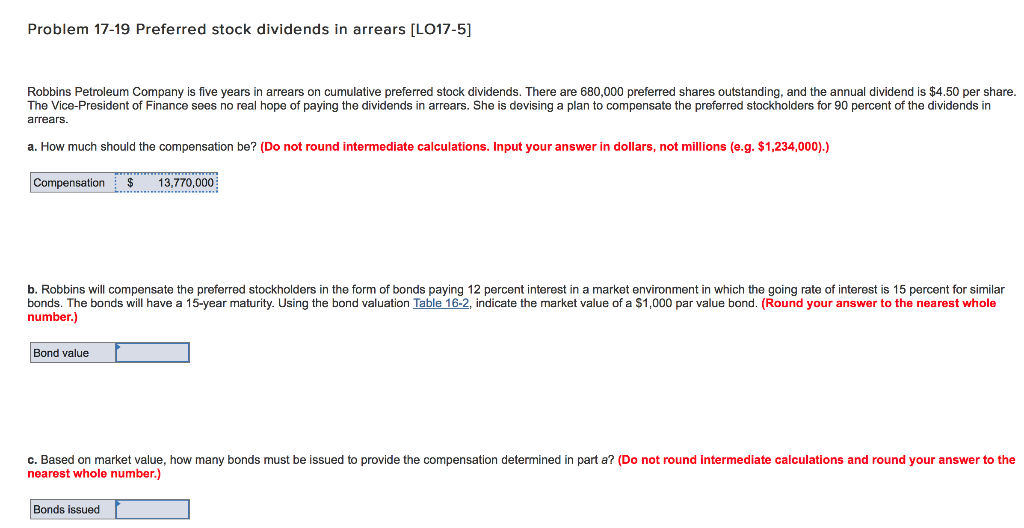

Of the 375000 that is declared they receive the 75000 due to them in year six. Pay any dividends in arrears. A dividend in arrears is a dividend payment associated with cumulative preferred stock that has not been paid by the expected date.

If the prospectus says the preferred stock is non-cumulative there will be no dividends in arrears. Dividends in arrears exist when a corporation has. Omitted past dividends on the cumulative preferred stock and the amount has not yet been paid.

If the corporation wants to pay any dividends to its common and preferred stockholders it must do the following. Preferred stock dividends are typically expressed as a. Dividends in arrears must be paid in full before the company sets aside any.

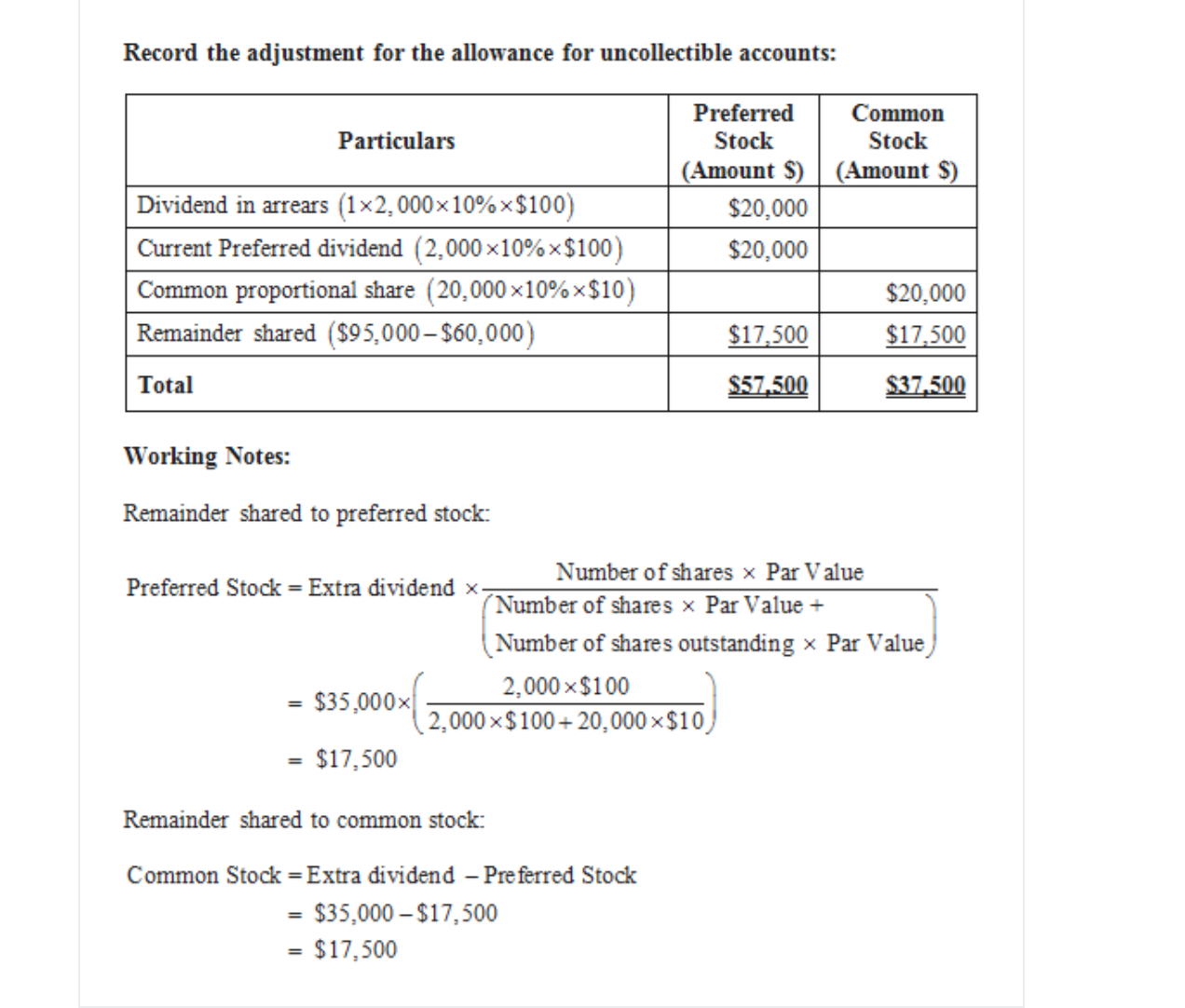

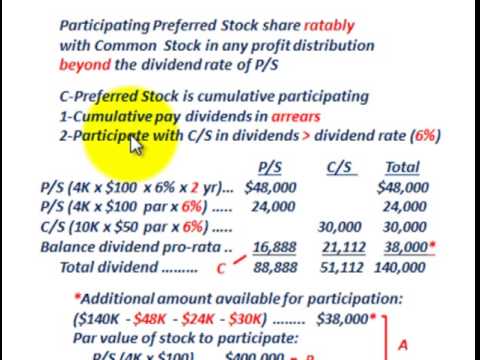

Once all cumulative shareholders receive. The cumulative preferred stock shareholders must be paid the 900 in arrears in addition to the current dividend of 600. 13 hours agoYoungevity International Inc.

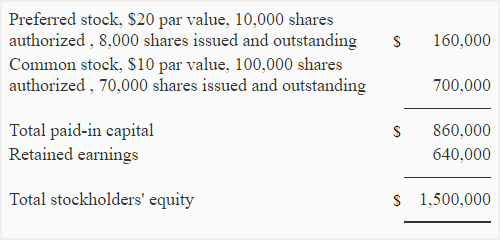

Priority Income Fund 6375 Series L Cumulative Redeemable Term. Cumulative Preferred Dividends in Arrears Should Be Shown in a Corporations Balance Sheet as What. Dividend in Arrears on.

YGYI YGYI or the Company today announced the declaration of its regular monthly dividend of 0203125 per share of its 975 Series D Cumulative. Accounting questions and answers. The key advantage of cumulative preferred stock is that the years in which the dividend is not paid will accumulate and will be paid to you at a later date.

Generally preferred stock will trade with a higher yield than the same companys bonds to make. The disclosure of dividends in arrears is an important financial indicator for investors and other users of financial statements. The schedule of payments lists the dates.

C must be paid before common stockholders can receive a dividend. True or False True False False. Such disclosure is made in the form of a balance sheet note.

D enable the preferred stockholders to share equally in corporate earnings with the common stockholders. D enable the preferred stockholders to share equally in corporate earnings with the common stockholders. If the preferred shares are cumulative the amount of dividends in arrears grows with each missed deadline for payment.

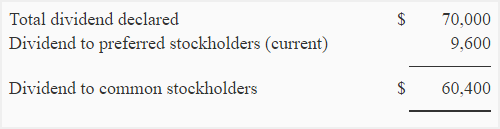

Common shareholders receive the remaining 300000. Dividends in arrears on cumulative preferred stock A should be recorded as a current liability until they are paid. Since 200000 is declared preferred stockholders receive 120000 of it and common shareholders receive the remaining 80000.

B never have to be paid even if common dividends are paid. C must be paid before common stockholders can receive a dividend. What Happens When the Dividend is in Arrears on Cumulative Preferred Stock.

Definition of Dividends in Arrears. While preferred stock normally pays regular dividends cumulative preferred stock. Gabelli Dividend Income Trust.

These dividends have not been authorized by the board of directors because the issuing entity does not. If you own cumulative preferred stock and the dividend is in arrears this will not affect you. Undeclared Dividends in Arrears.

Any unpaid dividend on preferred stock for an year is known as dividends in arrears. B never have to be paid even if common dividends are paid. Dividends in arrears are dividend payments that have not yet been paid on cumulative preferred stock also known as preference shares.

First determine the dollar amount of each of your preferred shares fixed quarterly dividends.

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Solved Dividends In Arrears On Cumulative Preferred Stock Chegg Com

Dheeraj On Twitter Dividends In Arrears In Cumulative Preferred Stocks Definition Https T Co U8m0grh9hc Dividendsinarrears Https T Co 8wwb2ppsys Twitter

How Are Dividends Paid When There Are Dividends In Arrears Accounting Services

Compute Preferred Dividend On Cumulative Preferred Stock With Dividends In Arrears Youtube

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Solved Problem 17 19 Preferred Stock Dividends In Arrears Chegg Com

Solved Question 21 1 Point Dividends In Arrears On Chegg Com

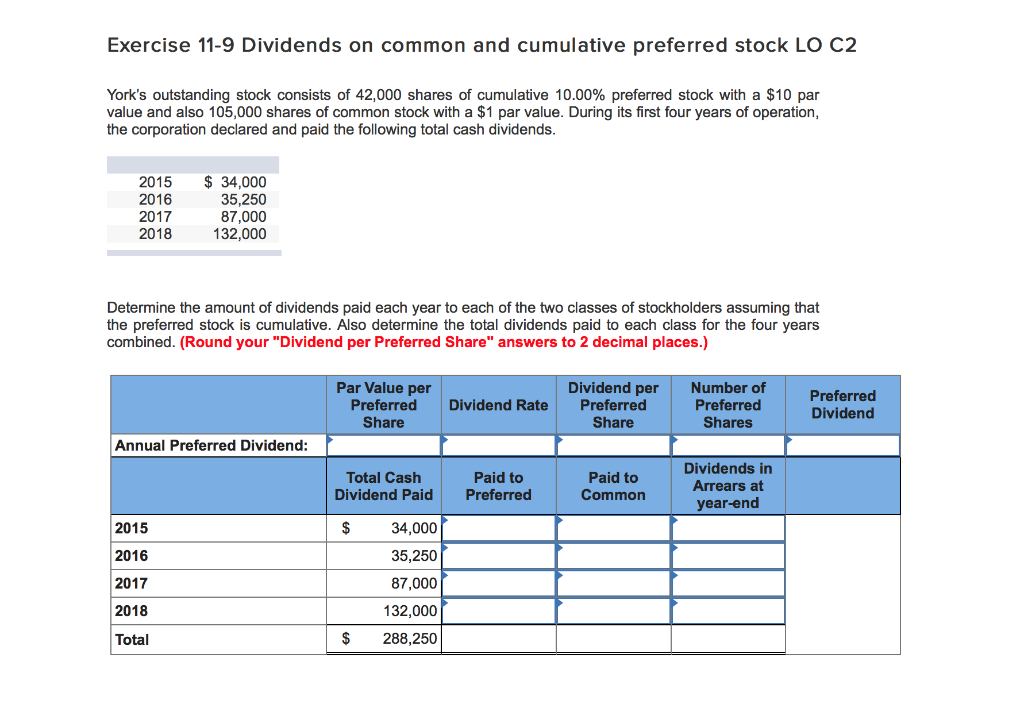

Solved Exercise 11 9 Dividends On Common And Cumulative Chegg Com

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Preferred Stock Cumulative Noncumulative Dividends Youtube

Answered A Corporation S Shareholders Are Not Bartleby

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

Solved Illustration Scientific Leasing Has 5 000 Shares Of Chegg Com

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Solved 9 Dividends In Arrears Are Dividends On A Chegg Com

Preferred Stock Cumulative Noncumulative Dividends Youtube

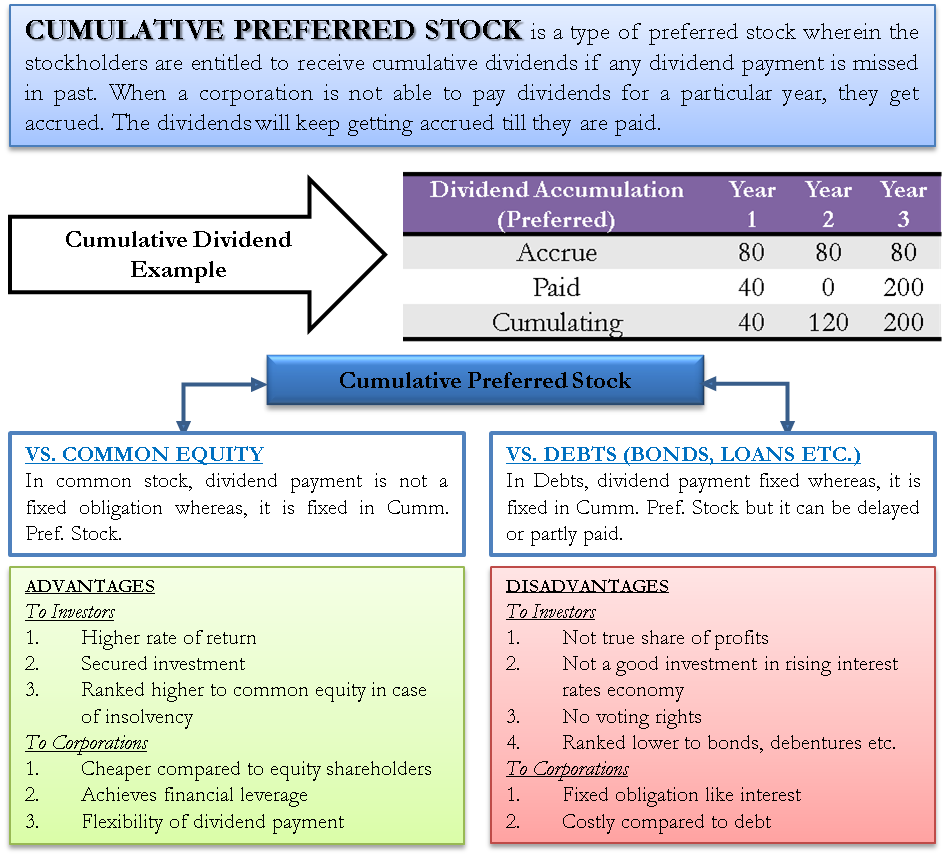

Cumulative Preferred Stock Define Example Benefits Disadvantages